For many Australians, independence flourishes when disability home care services tailored support arrive right at the doorstep. In the dental world, clarity begins with an orthodontic consent form ADA guidelines that spells out every step before braces go on. Though these resources serve different needs, both show how small shifts in everyday systems ripple outward, strengthening the fabric of our communities.

The Power of Incremental Progress

History loves dramatic breakthroughs, yet most quality-of-life gains stem from quiet refinements: a bus stop bench added for tired legs, a revised form printed in larger type, a neighbour who checks in after storms. Economists describe this as “marginal gains”—tiny enhancements that compound over time. When we seek 1 per cent improvements in multiple places, the cumulative benefit can feel revolutionary.

Health Literacy in Bite-Sized Pieces

Informed consent sits at the core of ethical healthcare, but consent documents too often drown readers in jargon. Breaking information into plain-English bullet lists, adding diagrams, and offering QR-code videos reduce cognitive load. Patients who truly understand treatment choices attend appointments more consistently and follow advice, boosting success rates. The result is a win-win: practitioners see better clinical outcomes, and families experience less anxiety.

Personalised Support at Home

Likewise, customised in-home assistance allows people with mobility limits to stay in familiar surroundings, safeguarding social ties and mental health. When caregivers schedule visits around an individual’s preferred routine—morning walks, afternoon hobby sessions—clients feel respected, not disrupted. Technology amplifies this: cloud-based rosters update instantly if staff fall ill, ensuring continuity; wearable sensors alert coordinators to unusual patterns such as skipped meals. Each feature is modest alone, yet together they weave a safety net that preserves dignity.

Community, Not Isolation

Stronger communities arise when people share responsibility for one another’s well-being. Libraries that stock accessible health brochures create informal learning hubs; local cafés that host “quiet hours” accommodate customers sensitive to noise. Even street design matters: kerb cuts initially installed for wheelchair users also help parents with prams, travellers with luggage, and workers with trolleys. By planning for diverse needs, councils foster public spaces where everyone participates rather than spectates.

Technology’s Gentle Push

Digital tools need not be flashy to be effective. A simple SMS reminder before an orthodontic check-up reduces no-shows, saving clinic time and patient travel costs. Video-calling platforms let carers perform quick visual wellness checks between in-person visits, catching issues early. Importantly, technology succeeds when it augments—not replaces—human connection. The most trusted systems balance automation with empathy, ensuring users still feel heard.

Sustainability Woven Into Care

Small improvements extend beyond personal comfort into environmental responsibility. Refillable disinfectant stations in home-care supply cupboards cut plastic waste; dental clinics that switch to digital impressions eliminate single-use mould trays. Energy-efficient LED lighting in patient rooms lowers electricity bills, freeing funds for extra support hours. These tweaks reduce the sector’s footprint while modelling stewardship for future generations.

Education as Prevention

Schools and community centres increasingly run workshops that demystify topics such as brace maintenance or mobility-aid funding. When young people learn to floss properly or adjust a walking frame height, they carry those habits for decades. Prevention costs less than treatment, and each individual adopting healthier routines relieves pressure on public systems. Knowledge shared early is arguably the ultimate incremental upgrade.

The Role of Policy Nudges

Government initiatives can accelerate adoption of micro-innovations. Subsidies for home modifications—grab rails, ramp access, smart doorbells—lower upfront costs for households. Mandating plain-language medical documents sets a baseline for accessibility across every clinic. Even small policy nudges, such as tax rebates on ergonomic furniture, encourage broader cultural shifts toward inclusive design.

Barriers and Bridges

Of course, incremental change faces obstacles: budget constraints, resistance to new workflows, information overload. Success stories reveal common threads for overcoming these hurdles: pilot programs that prove return on investment, peer champions who model new practices, and feedback loops that refine solutions in real time. Celebrating quick wins—like reduced appointment cancellations or fewer hospital readmissions—builds momentum for larger roll-outs.

Looking Ahead

Tomorrow’s everyday improvements may include dental consent forms read aloud by AI for vision-impaired patients, or home-care dashboards that integrate weather alerts so carers can plan safe travel routes. Advances in 3-D printing could produce custom adaptive cutlery on demand, while smart fabrics embedded with gentle vibration cues might remind wearers to shift posture, preventing pressure sores. Each idea sounds small—until multiplied across thousands of lives.

Tiny adjustments often slip under the radar, yet their impact widens circles of independence, trust and sustainability. By valuing detail—whether that is a clearer dental pamphlet or a perfectly timed home visit—we create communities where everyone can thrive.

industry. It’s unheard of for artists to call their fans “customers” even though that’s exactly their role. Every art installation, every music is produced and sent out to the world with the underlying hope that people will buy it. This is why some musicians have business advisors and marketing specialists.

industry. It’s unheard of for artists to call their fans “customers” even though that’s exactly their role. Every art installation, every music is produced and sent out to the world with the underlying hope that people will buy it. This is why some musicians have business advisors and marketing specialists.

appeals to people’s emotions. If you really think about it, the meaning sums the whole process of web design. Designing a website is not an easy task especially if you’re not artistically inclined. A lot of professionals in this field are considered artists because they can create something unique and amazing from scratch.

appeals to people’s emotions. If you really think about it, the meaning sums the whole process of web design. Designing a website is not an easy task especially if you’re not artistically inclined. A lot of professionals in this field are considered artists because they can create something unique and amazing from scratch.

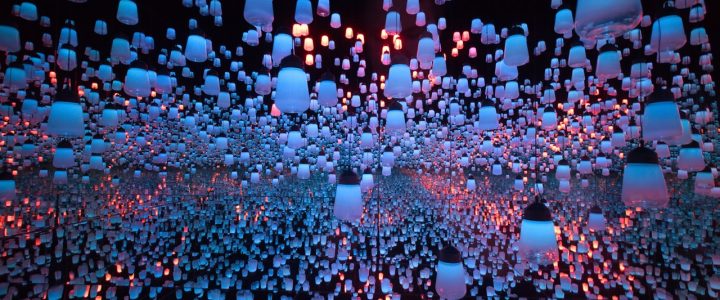

Art Cloud is an online art gallery that uses a cloud management system program for galleries, artists, collectors and advisers. I began using Art Cloud this week, and first and foremost I find this system simple, and easy to use. Their how-to guide comprises simple and easy to read, and to follow directions. That is a huge plus for me. (There is nothing more frustrating than searching for help with a site feature only to experience endless text to read.)

Art Cloud is an online art gallery that uses a cloud management system program for galleries, artists, collectors and advisers. I began using Art Cloud this week, and first and foremost I find this system simple, and easy to use. Their how-to guide comprises simple and easy to read, and to follow directions. That is a huge plus for me. (There is nothing more frustrating than searching for help with a site feature only to experience endless text to read.)

shaped — and continues to shape — how we live. While there are a number of lapses in that narrative, the exhibition, titled “Past Forward: Architecture and Design at the Art Institute,” is, for the most part, has been intelligently told.

shaped — and continues to shape — how we live. While there are a number of lapses in that narrative, the exhibition, titled “Past Forward: Architecture and Design at the Art Institute,” is, for the most part, has been intelligently told. The Art Institute’s design and architecture holdings, as extensive as they are, aren’t all-encompassing, which leads to a frustrating gaps. The section on

The Art Institute’s design and architecture holdings, as extensive as they are, aren’t all-encompassing, which leads to a frustrating gaps. The section on